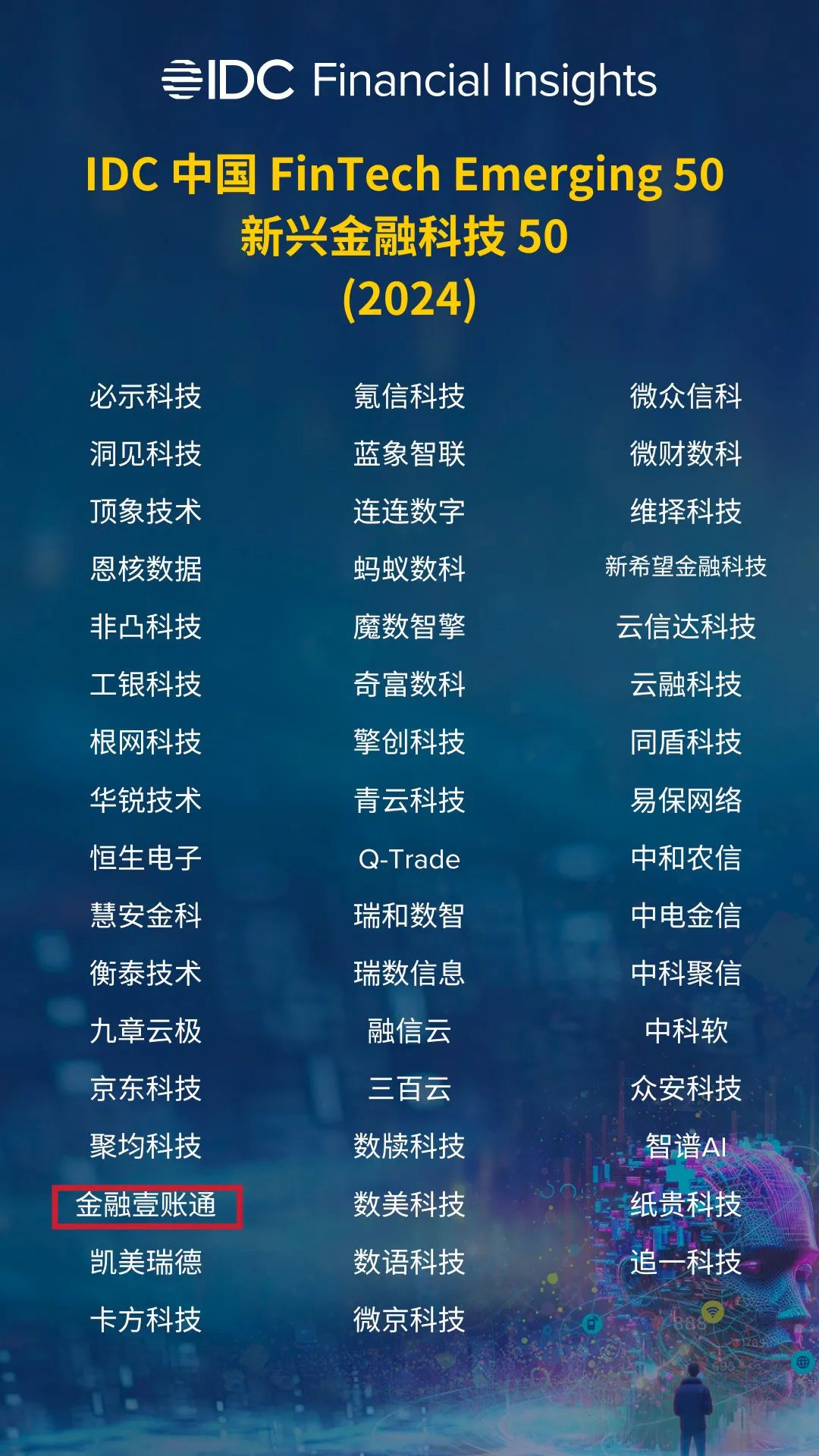

OneConnect Recognized in the "2024 IDC China Top 50 Emerging FinTech" for the Fifth Consecutive Year

On August 8th, International Data Corporation (IDC) released its 2024 IDC China FinTech rankings, with OneConnect earning a spot in the prestigious "IDC China Top 50 Emerging FinTech" list. This marks the fifth consecutive year that OneConnect has been recognized in the IDC China FinTech series. This accolade not only highlights OneConnect's innovative achievements in FinTech but also underscores its outstanding capabilities in technological innovation and global reach.

As a commercial technology service provider for financial institutions, OneConnect leverages over 30 years of financial industry experience from the Ping An Group to continuously invest in technological innovation. The company has built a leading technology framework centered around artificial intelligence, big data, and blockchain. These technologies have not only helped clients improve efficiency and service quality but have also played a critical role in reducing operational costs and risks. These robust technological capabilities have enabled OneConnect to secure a strong position in both the Chinese and global FinTech markets.

In 2021, OneConnect introduced its “One Body, Two Wings” strategic plan, seamlessly integrating technology with business operations. This plan focuses on the needs of financial institutions, offering integrated technological solutions such as digital banking, digital insurance, and the Gamma Platform. By addressing the business challenges of financial institutions with its "consulting + implementation" solutions, OneConnect has helped clients navigate the complexities of digital transformation, from upgrading retail banking operations and optimizing SME lending to enhancing insurance claims efficiency. OneConnect’s technological solutions have been widely adopted across various financial sectors.

OneConnect’s digital banking product suite, including "Banker E-Marketing," digital lending, and core banking systems, has continued to evolve, aiding financial institutions in retail transformation and SME lending upgrades. The digital insurance segment, featuring end-to-end P&C systems and the "All-in-One Agent" life insurance product, has also achieved global success. Additionally, the Gamma Platform, with its smart vision and open platform products, offers flexible, customized solutions to support the digital transformation of financial institutions.

OneConnect has not only made significant strides in the domestic market but has also aggressively expanded internationally, now serving 185 financial institutions across 20 countries and regions. With its expertise in cutting-edge technology and deep industry experience, OneConnect’s products and services have gained global recognition. This latest award in the "IDC China Top 50 Emerging FinTech" further solidifies OneConnect’s leadership in the global FinTech industry.

Leveraging powerful technologies like artificial intelligence, big data, and blockchain, OneConnect has previously been listed in KPMG's "China Leading FinTech 50" and the IDC FinTech Top 100 Global rankings for six consecutive years. The company has also won numerous awards, including the Wu Wenjun AI Science and Technology Progress Award and the National May 1st Labor Medal, and has achieved CMMI5 international certification.

As a leading global IT market research and consulting firm, IDC monitors FinTech innovation with a global perspective, continually tracking and evaluating FinTech companies. Since 2020, IDC has released its “IDC China FinTech” series annually, focusing particularly on emerging companies in their early stages. These companies empower industry users through technology, with a focus on vertical financial scenarios such as payments, risk control, and insurance.

Being named to the "2024 IDC China Top 50 Emerging FinTech" list not only reaffirms OneConnect's leadership position in the industry but also lays a solid foundation for its continued expansion in the global market. Moving forward, OneConnect will prioritize product upgrades and deepening customer relationships, leveraging its technological innovation and digital capabilities to continuously deliver smarter, more customized solutions that lower operational costs, improve efficiency, and support the high-efficiency, secure digital transformation of financial institutions worldwide.