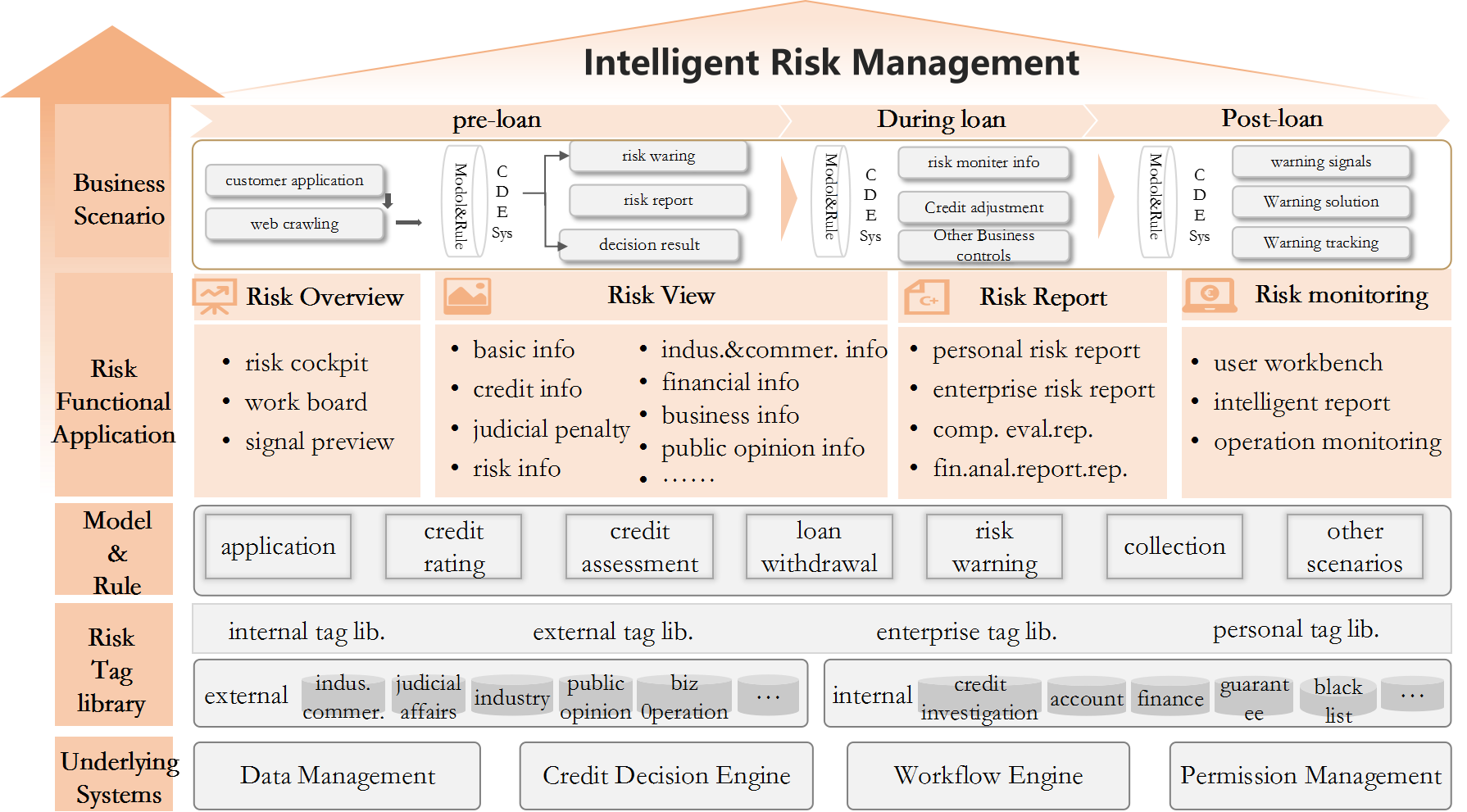

Based on the design concept of online, process oriented, and visualization, technology, data, and scenarios are combined, and models and views are integrated to achieve online automated evaluation, intelligent approval, intelligent warning, intelligent collection, intelligent analysis.

Business Challenges

-

Insufficient application of data mining

Insufficient application of data miningInternal data is scattered, insufficient sedimentation, difficult to mine, and insufficient application.

-

Unclear information visualization

Unclear information visualizationInsufficient information integration, lack of intuitive visualization, and incomplete customer persona.

-

Manual approvals rely on experience

Manual approvals rely on experiencePoor customer experience due to manual approvals that mainly rely on experience and with strong subjectivity

-

Passive and lagging risk monitoring

Passive and lagging risk monitoringProactiveness and timeliness are difficult to improve due to risk monitoring mainly relies on manual labor.

Comprehensive covering, real-time monitoring, and intelligent recognition,which help to build a full lifecycle and full chain of digital risk control.

Product Strengths

-

Scenario-based risk control

Scenario-based risk controlThe scenario-based risk control system consists of 8 categories and 30 + scenario models.

-

Refinement of Risk Control

Refinement of Risk ControlA four-step method of diagnosis, positioning, optimisation and monitoring refines risk control and increases the approval rate by 15%.

-

Intelligent Risk Control

Intelligent Risk ControlFully automated online risk monitoring and close-loop management of monitoring targets based on 5000+ data labels, achieving 90% early warning accuracy rate.

Customer Cases

-

Assisting a national joint-stock bank to establish a digital risk early warning system

Assisting a national joint-stock bank to establish a digital risk early warning systemOneConnect integrates 80 + label systems inside and outside the industry, and monitors the situation of enterprises in real time all day long with big data.

OneConnect integrates 80+ label systems inside and outside the industry, and monitors the situation of enterprises in real time all day long with big data.

FNN machine learning model with 2300 model variables and 180+ significant variables creates 600+ early warning rules to make an all-round risk early warning system.

Combined with post-loan early warning, inspection and collection, the red flag of large post-loan closed-loop management is pushed in real time. The system is also supported by various AI tools to conduct mobile end due diligence check, automatic post-loan report generation, and automatic grouping collection.

-

Assisting a rural commercial bank to establish a digital pre-loan risk control system

Assisting a rural commercial bank to establish a digital pre-loan risk control systemOneConnect has greatly improved the level and intelligence of bank risk control decisions by building an online big data risk control system for personal consumption loan products.

OneConnect integrated 200+ risk control labels inside and outside the industry, and created 80+ rule to form a full life cycle credit management from anti-fraud, credit strategy, risk control model, quota pricing and post-loan monitoring.

Since its launch, the approval pass rate exceeds 40%, and the non-performing rate is no more than 1%

- Solution Overview

- Business Challenges

- Product Solutions

- Product Strengths

- Customer Cases

Does this page meet your needs?

-

Yes

-

No

Your recognition and praise will motivate us to better improve the website experience