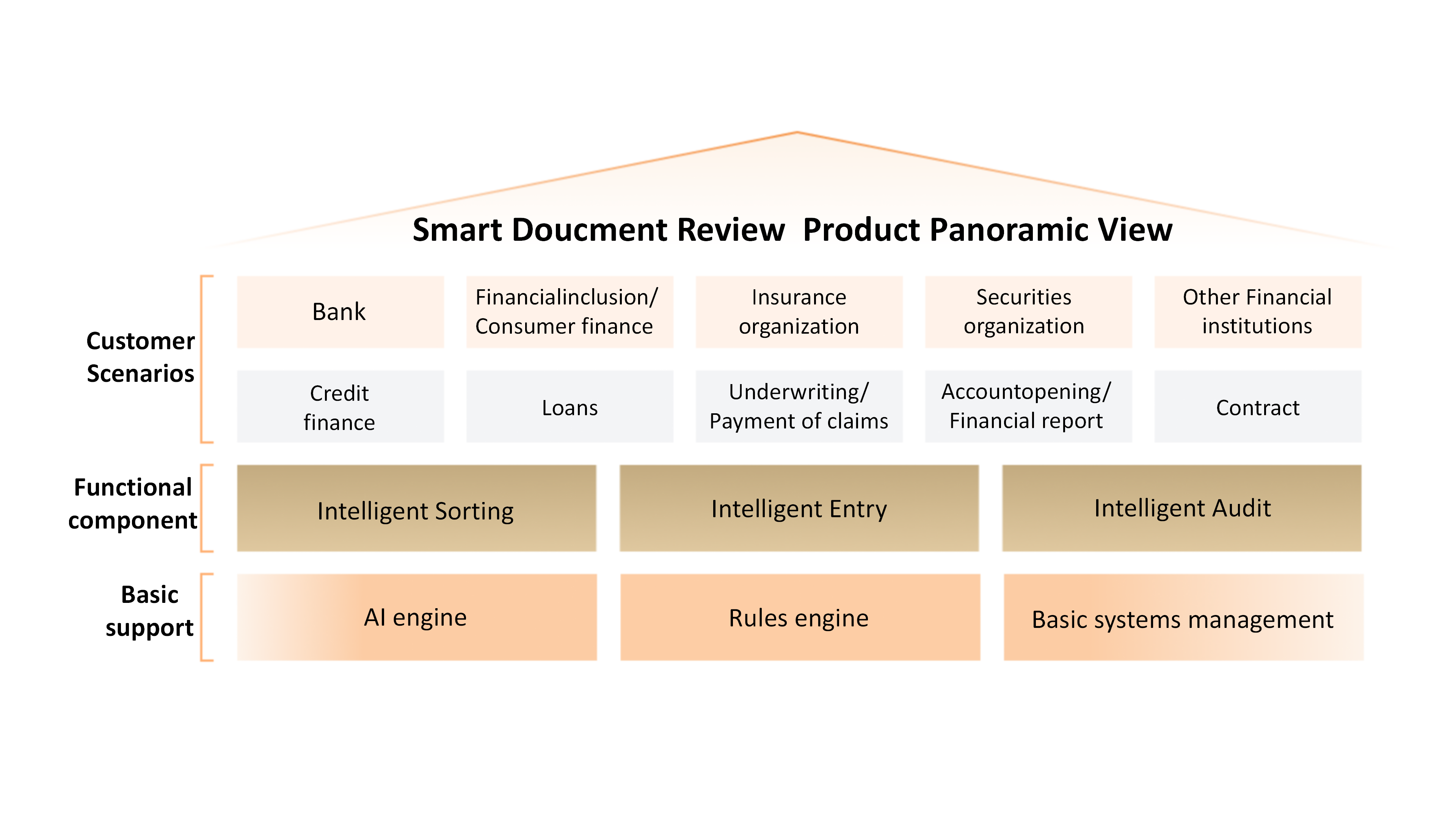

Leveraging Ping An's extensive experience in financial risk control, this innovative intelligent document review product integrates AI technologies such as RPA (Robotic Process Automation), OCR (Optical Character Recognition), NLP (Natural Language Processing), and rule engines. The product aims to replace manual document reviews with AI, helping financial institutions in scenarios like credit management, financial transactions, and cross-border transactions to improve operational efficiency, reduce review costs, and enhance risk control.

Business Challenges

-

Low input efficiency

Low input efficiencyManual data entry takes a long time, the processing capacity is limited, and the work is highly repetitive, making it prone to errors.

-

High review costs

High review costsThere are many types of documents to review, with numerous key points to check, leading to high review costs.

-

Difficult data management

Difficult data managementIt is challenging to correlate data, making it hard to organize, and the value of existing data is low.

-

High risk control difficulty

High risk control difficultyRelying on experts provides limited coverage, and some risk points are deeply hidden and difficult to detect.

The intelligent classification module enables batch sorting of documents, and the intelligent input module automates data entry. Combined efficiently with the intelligent review module, which conducts intelligent document reviews, these components overcome the manual bottlenecks in document review, achieving digitalization and automation of the document review process.

Product Strengths

-

Flexible Compatibility

Flexible CompatibilityEasily adapts to existing business systems, combining automated and assisted processes to enhance operational efficiency and reduce costs.

-

Automated Review

Automated ReviewThe entire process, from data entry to the output of review results, is handled by AI capabilities (OCR, NLP, RPA, etc.), without the need for human intervention.

-

Safe and Reliable

Safe and ReliableLeveraging extensive experience in financial risk control, the rule engine drives document review rule validation, supporting diverse and complex application scenarios.

Customer Cases

-

Automated Reconciliation Service Project for a Renowned Consumer Finance Institution

Automated Reconciliation Service Project for a Renowned Consumer Finance InstitutionSaved over 40 person-years in review manpower costs, with daily processing volume increased to over 5,000.

-

AI Contract Review Project for a Prominent Telecom Operator

AI Contract Review Project for a Prominent Telecom OperatorResponding to quality problems of regulatory data, a "two-wheel drive" governance mechanism is established with over 800 regulatory dedicated data standards and "5 + 1" governance papers and online support tools.

Financial document entry efficiency improved by over 60%, with over 20,000 contracts reviewed annually.

-

Trade Finance Scenario for a Well-Known Foreign Bank

Trade Finance Scenario for a Well-Known Foreign BankDocument review efficiency increased by 60%, with over 300 automated review rules established.

- Solution Overview

- Business Challenges

- Product Solutions

- Product Strengths

- Customer Cases

Does this page meet your needs?

-

Yes

-

No

Your recognition and praise will motivate us to better improve the website experience