For four consecutive years, OneConnect has retained its position on the "IDC China Fintech 50" list.

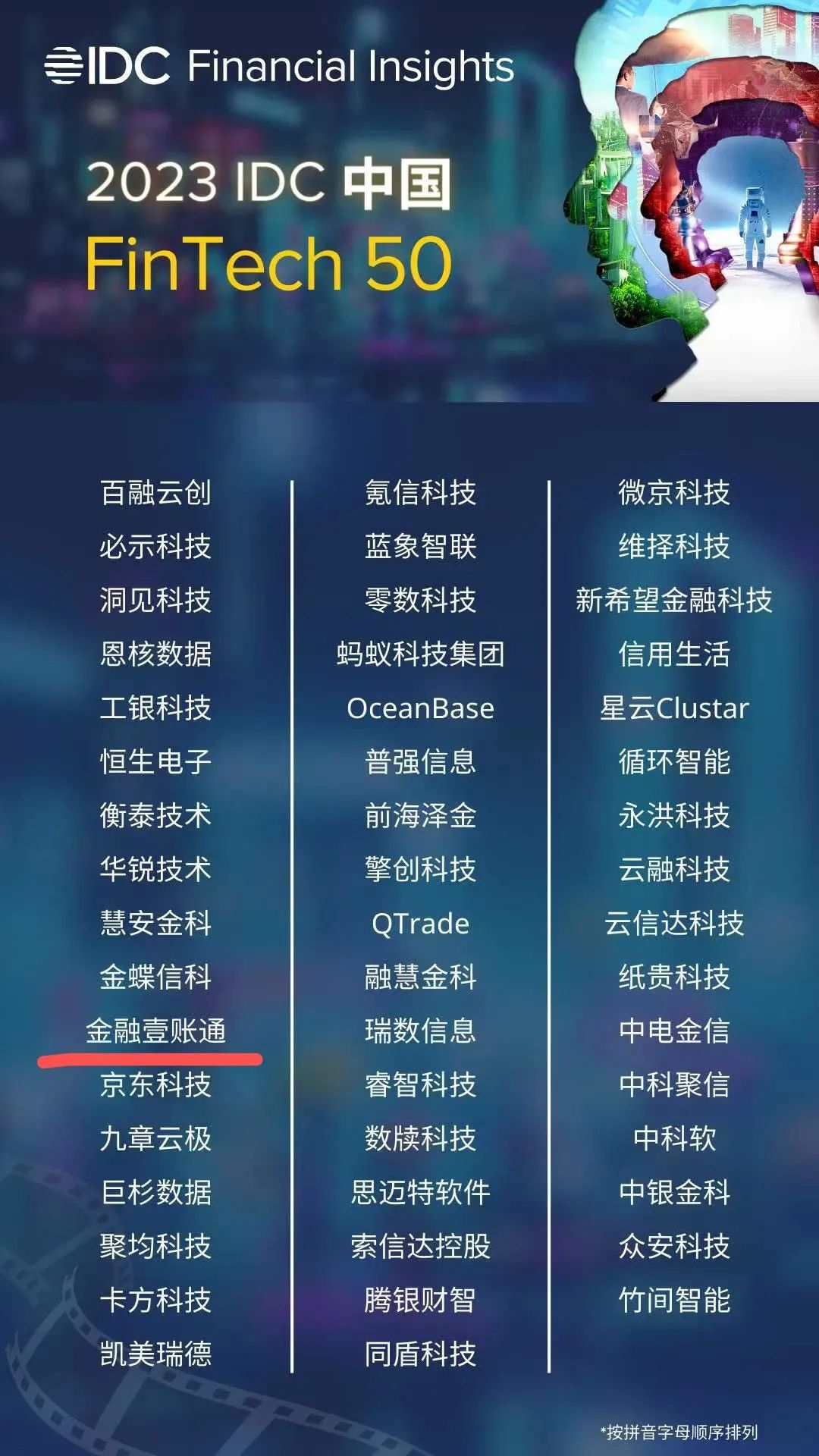

On August 16, International Data Corporation (IDC) announced the 2023 "IDC China FinTech 50" list, featuring companies like Industrial Bank Technology, Ant Group, and OneConnect. OneConnect, as a pioneer in the digital upgrade of domestic financial institutions, has been selected for the "IDC China FinTech 50" list for the fourth consecutive year. This recognition underscores the industry's acknowledgment of OneConnect's professional capabilities and its value in empowering financial institutions.

IDC, one of the earliest global renowned technology market research institutions to enter the Chinese market, is known for its authoritative status. The "IDC China FinTech 50" list was first launched in 2020. According to IDC's official selection guide, candidate companies should be technology vendors empowering the financial industry with cloud computing, big data, artificial intelligence, blockchain, the Internet of Things, and other innovative technologies. The guideline requires that "at least one-third of the total revenue comes from technology services provided to third-party licensed financial institutions, maintaining at least three years of continuous and stable operation."

As a Technology-as-a-Service Provider for financial institutions, OneConnect is the first fintech company to be dual-listed in New York and Hong Kong. Relying on Ping An Group's over 30 years of rich experience in the financial industry and independent research capabilities, OneConnect's unique competitive edge lies in its "technology + business" approach. It helps clients improve efficiency, services, reduce costs, and risks, thereby achieving digital transformation. To date, it has cooperated with 85 government and regulatory bodies in China and served 170 overseas financial institutions in 20 countries and regions.

In September 2021, OneConnect announced a five-year strategic transformation plan "One Body, Two Wings," focusing on serving financial institutions as the "body" and building government regulatory and corporate user ecosystems, and expanding overseas markets as the "two wings." It created integrated products with "horizontal integration and vertical full coverage" around the "body" — digital banking, digital insurance, and the Gamma Platform, focusing on the pain points of financial institutions' business scenarios with "consulting + implementation" innovative digital solutions.

In recent years, its flagship digital banking products like Smart Banker, Digital Lending, Banking Core Systems, and Super Brain have been continuously upgraded and iterated, enabling the retail transformation of 15 financial institutions, aiding 76 financial institutions in upgrading their small and micro-credit businesses, and serving over 100,000 SMEs. The digital insurance segment's core claims system has been continually upgraded. Its online claims workstation can help insurance companies reduce 30% of survey manpower and operational costs, and the efficiency of backend claims personnel has improved by 25%. The first digital life insurance product "All-Powerful Agent" aimed at the global life insurance agent market has been successfully launched overseas, bringing Ping An's verified digital transformation experience to the global market.

Additionally, the Gamma Platform, aiming to build a digital infrastructure for fintech, integrates various solutions that can be widely applied to multiple financial business scenarios through products like smart voice, open platform, and cloud services, allowing for flexible customization of client-specific needs. To aid financial institutions in domestic intelligent transformation, OneConnect has continuously deepened its adaptation to trusted computing, creating a new generation core system "1+1+4+N" — one underlying infrastructure, one core system, and four core businesses including savings, loans, and payments.

Since its inception, 100% of China's state-owned banks, 98% of city commercial banks, 65% of property insurance companies, and 49% of life insurance companies have used at least one product from OneConnect. With its strong capabilities in artificial intelligence, big data, and blockchain technologies, OneConnect has been selected for the KPMG "China Leading Fintech 50 Companies" list and the IDC FinTech Global Top 100 list for five consecutive years. It has won the Wu Wenjun Artificial Intelligence Science and Technology Progress Award, the highest award in China's intelligent science and technology field, the National May Day Labor Medal in 2023, 70 various international professional awards, and has received the CMMI5 international certification. As of December 31, 2022, OneConnect has filed a total of 5,905 global patent applications.

In the future, OneConnect will focus on product upgrades and deep customer cultivation, committed to reshaping the financial industry with technological innovation and digital empowerment. By providing "technology + business" solutions to financial institutions, OneConnect aims to reduce operational costs, improve operational efficiency, and contribute to the high-quality development of the digital economy.