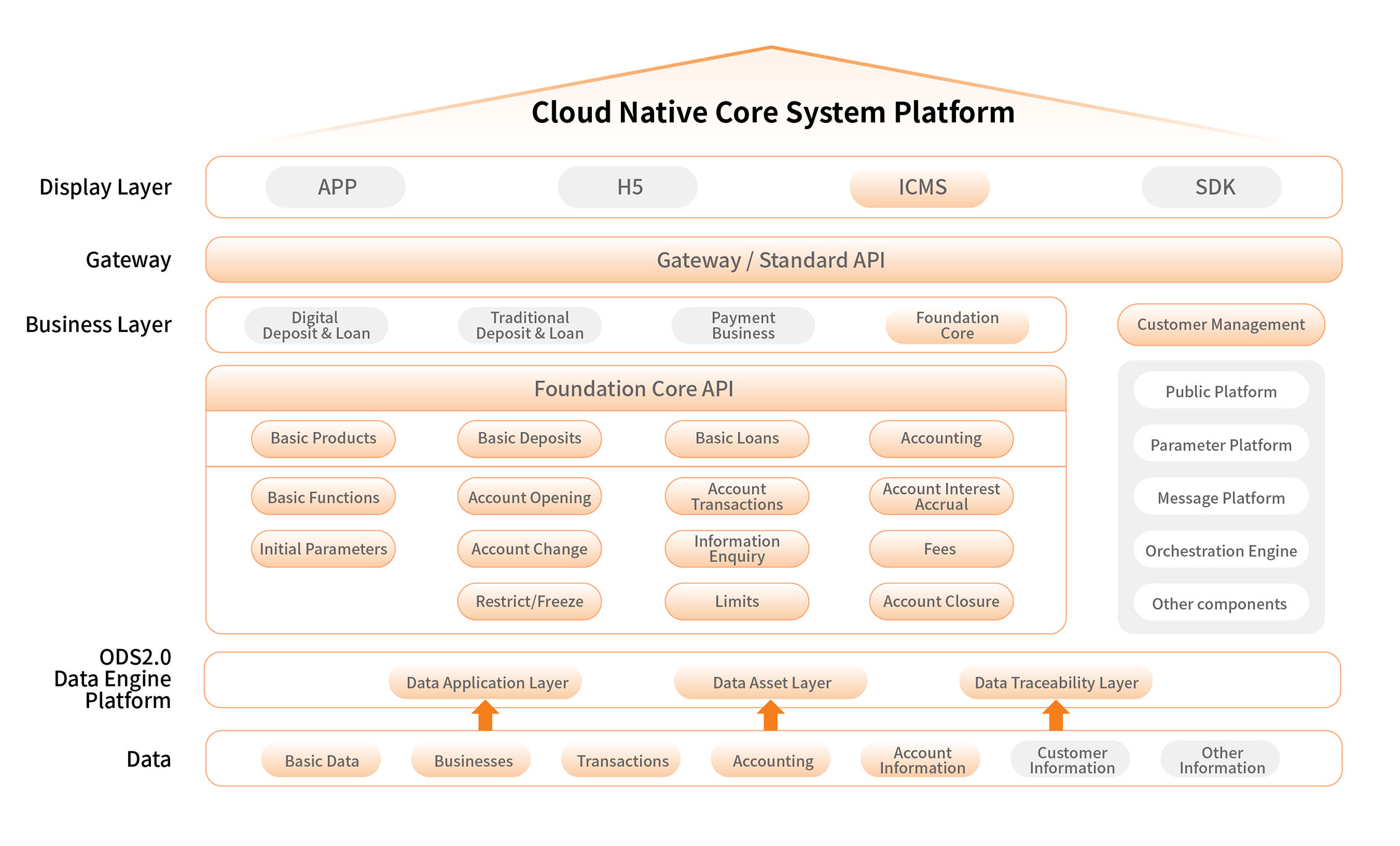

Cloud native core system platform provides basic services such as deposit and loan, customer information based on distributed architecture, including over 300+ basic APIs and intelligent parameter operation system to provide core operation platform for digital banks, achieving 3 core values of "simpler, smarter and better experience" for digital transformation of banks.

Business Challenges

-

Difficult O&M

Difficult O&MLarge performance bottlenecks: traditional architecture is facing huge challenges with 20-100 TPS being difficult to support high concurrent innovative business; High O&M costs: ¥20-100 per account with 10-20% server utilization

-

Weak innovation

Weak innovationSlow product launch: the launch of new products under traditional core system takes up to 3-6 months, affecting the ability to capture market opportunities. Slow progress of digital operation: rapid expansion of ecological scenario applications has higher requirements for open ecological construction based on standard API

-

Poor experience

Poor experienceLong construction cycle: the construction cycle for digital transformation and migration of old systems is long. Usually 200+ systems are intertwined and the transformation takes a long time (more than 3-5 years is common). There is slow progress for business operations and huge pressure on IT departments Customize

Cloud native core system platform includes deposit accounts, loan accounts, separate accounting, customer information, ODS, reporting, core API

Payment platform includes payment process management and processing, appointment transfer, payment voucher management, reconciliation, error handling

OpenBank API supports banks and partner service providers to combine and apply application programming interface (API), software development kit (SDK), HTML5 front-end technology page (H5), etc. in different application scenarios.

Product Strengths

-

Simpler

SimplerImproved Performance: 500 million+ accounts with 20,000+ TPS ultra-high performance; Within-a-second scaling : flexible resource scaling and infinite expansion; Reduced cost: single account operating cost is as low as ¥1/year.

-

Smarter

SmarterBoosted innovation: extreme distribution form and customized digital bank; Expanded eco-system: 300+ standard APIs for flexible combination; Quick launch: new business can be launched in as short as 1 day.

-

Better Experience

Better ExperienceComplete platform: complete cloud-native core system, one-click deployment and fast opening in 6-9 months; End-to-end digital operation: reduce operational costs by over 60% and increase automation rate to 90%.

Customer Cases

-

Assisting a major overseas bank to experience full digitalization

Assisting a major overseas bank to experience full digitalizationComments from the bank's CEO: -- "Congratulations to the OC team! We are proud to see that the MVP version of Revi Loan Core alone has generated as much business in the six months it has been launched as it has in the past two years"

Pure online account opening: end-to-end account management and account opening can be as fast as 5 minutes.

Improved approval efficiency: quick loans only take as short as 8 minutes, complex approvals in an average of 1 day, which is 100% increase in overall approval volume.

Enhanced customer acquisition efficiency: 110,000 new loan customers in 7 months.

Distributed account system design: daily accrual is decoupled from EOD. Targeted single account accrual calculation effectively reduces EOD operational pressure.

Convenient post-administration services: automated account reconciliation, automated fault tolerance and recovery mechanisms, service scheduling engine, etc. improve business operation efficiency by 3 times.

Innovative product design: supports flexible customisation based on customer type, interest rate, geography, channel and other aspects to quickly combine products. An innovative intelligent line of credit product has been launched with a total lending of ¥4.1 billion in 7 months.

Fast EOD: 30 minutes to complete core EOD for 6 million customers.

Data-driven operation: based on ODS service capability, ODS+ various data application solutions are formed, such as ODS+ regulatory bailout and ODS+ asset management.

API bank: 152 standard APIs, 50% improvement in business operation efficiency, and completion of standardized access for 10+ partners.

Eco-operation: provide scenario-end product design and professional business operation cooperation services.

- Solution Overview

- Business Challenges

- Product Solutions

- Product Strengths

- Customer Cases

Does this page meet your needs?

-

Yes

-

No

Your recognition and praise will motivate us to better improve the website experience