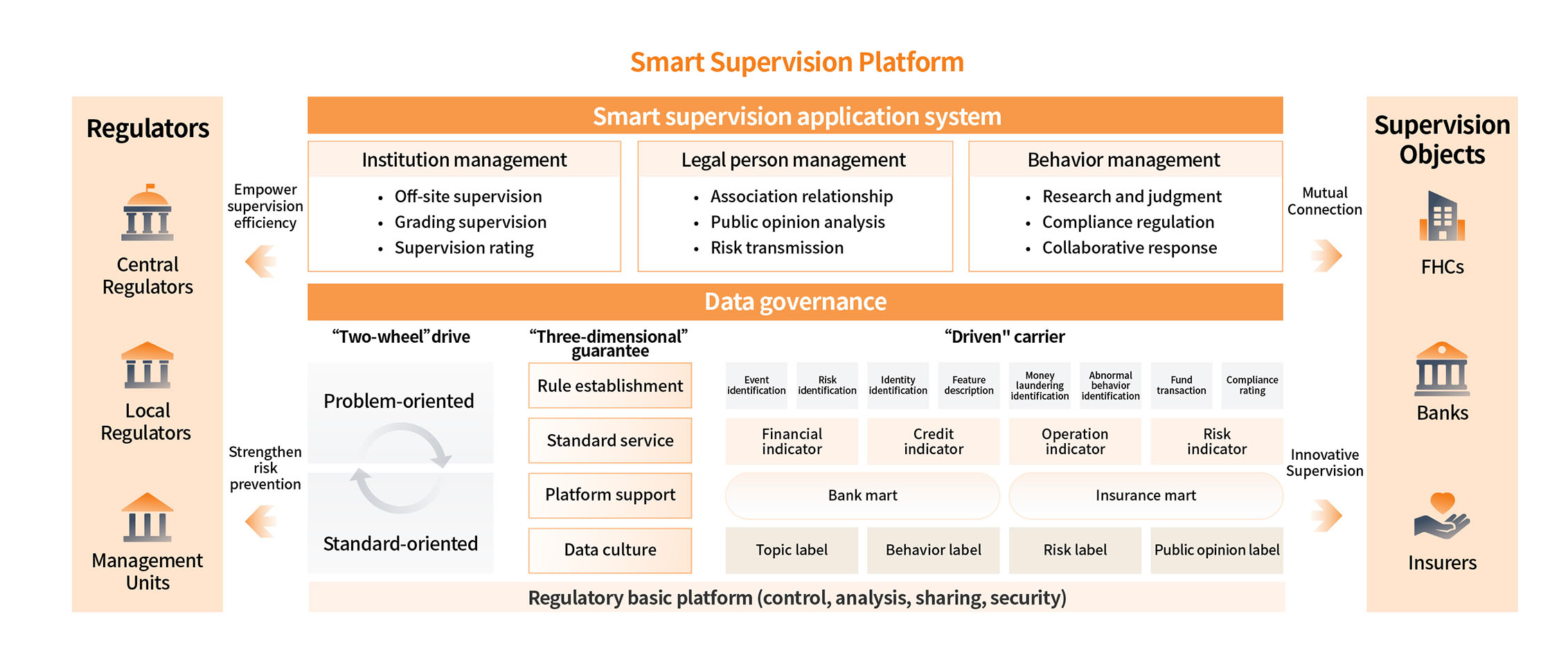

The "Kunlun Mirror" system fully empowers the regulatory authorities to foster their efficiency in off-site supervision, risk judgment and analysis, and governance compliance with technologies such as big data and AI. A smart supervision system managing institutions, legal persons, behaviors and governing data has come into being.

Business Challenges

-

Barriers to data and information

Barriers to data and informationThe complexity and diversity of functions, objects and businesses make the supervision departments have information barriers. The decentralized management also causes great hardship for the departments to supervise the industry.

-

Obstacles to determination and judgment

Obstacles to determination and judgmentManual prevention can no longer meet the current needs of supervision, and technical prevention ability needs to be strengthened. For example, the unclear responsibilities of investigation, evidence collection, analysis, judgment and characterization before filing a case loosen the connection between administration and justice, which affects daily supervision work.

-

Difficulty in decision-making and control

Difficulty in decision-making and controlThe lack of information means makes it difficult to grasp the opportunity to crack down on illegal fund-raising. The uncompleted daily registration and custody system and data deficiency lowers the efficiency of controlling personnel, funds, assets, and events in emergency.

-

Hindrance to coordination and processing

Hindrance to coordination and processingFinancial institutions have diverse businesses and systems, so it is difficult to coordinate and unify standards by themselves, causing great trouble for regulatory authorities to collect and analyze data.

Three major scenarios

Normal supervision: Based on the application of big data technology, driven by data and business models, the product covers the whole process of daily supervision work, and forms a closed-loop supervision model combining access, management, rating, compliance rectification and retreat.

Warning and judgment: Using big data, AI and other technologies, the product carries out monitoring, quantification, early warning and judgment on financial risks, and assists the regulatory authorities to pinpoint larger issues, so as to effectively prevent financial risks.

Regulation and governance: Through multi-dimensional grid management methods such as intelligent analysis of complaints and reports, and monitoring of fund changes, the product creates a new sample of regulatory governance in the financial sector.

Product Strengths

-

Collaboration

CollaborationThrough clue screening, change analysis and disposal, a horizontal and vertical collaborative mechanism is constructed to comprehensively track and dispose of the results.

-

Normalization

NormalizationData collection and analysis are carried out in an off-site standardized data reporting mode to support classified supervision.

-

Digitization

DigitizationThrough big data, financial behavior and risks will get identified and judged. Moreover, our product constructs models for regulatory compliance, intelligent analysis, risk warning and institutional rating around different scenarios.

-

Grid division

Grid divisionEstablishing a grid-based complaint reporting system to play the role of frontline people with diverse label systems covering emotion, region, field, group, early warning and perception.

Customer Cases

-

Build a regulatory data governance platform for one local office of CBIRC in northern China

Build a regulatory data governance platform for one local office of CBIRC in northern ChinaThe platform leverages big data technology to build a verification system and two-end verification system with EAST and 1104 data.

It can effectively identify and calculate the quality problems of data reported by regional financial institutions. Moreover, a compliance warning section was developed, forming regular supervision reports and identifying problems on business compliance through compliance reporting data.

200 + compliance warning models

100 + two-end verification rules

4000+ rules

-

Effectively monitor fund changes for one local financial bureau in southern China

Effectively monitor fund changes for one local financial bureau in southern ChinaHelp the Financial Bureau to set up four warning analysis models and 411 reporting mechanisms for illegal fund-raising, and detect abnormal changes of institutional funds with illegal fund-raising risks. Our work yielded great results. At the initial stage, 60 warning cases were monitored monthly.

1 system: a smart monitoring and analysis system for fund changes

4 models: models monitoring illegal fund-raising

411 fund reporting mechanisms

- Solution Overview

- Business Challenges

- Product Solutions

- Product Strengths

- Customer Cases

Does this page meet your needs?

-

Yes

-

No

Your recognition and praise will motivate us to better improve the website experience