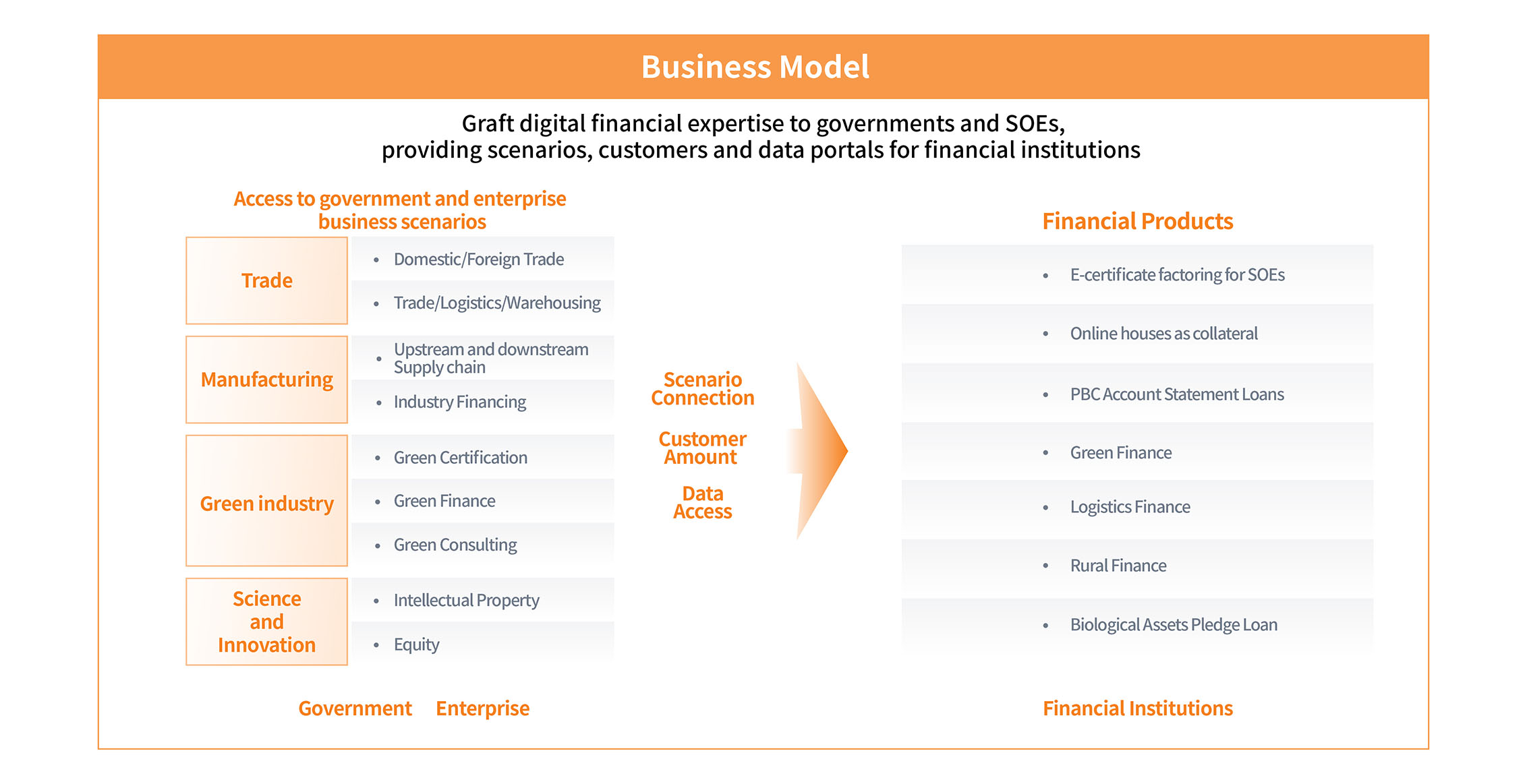

A digital eco-platform is established through the joint construction of digital intelligence products and digital intelligence risk control. A scenario + financial service operational eco-model is rapidly constructed to achieve the interconnection of ecology and finance, and jointly serve the real economy.

Business Challenges

-

Eco-transaction model

Eco-transaction modelCustomised scenario eco-transaction model leads to high costs of risk control during the process.

-

Ecological data types

Ecological data typesScenario ecological data types vary greatly, and it is difficult to utilize financial products combined with digitalised information.

-

Ecological digitisation

Ecological digitisationToo many digital forms of eco-scenarios lead to poor adaptation of single-dimensional products

13 digitally empowered functions help to build a digital and open eco-platform for"scenario + financial services"

Product Strengths

-

Connect from one point with panoramic response to enhance efficiency

Connect from one point with panoramic response to enhance efficiencyConnect government with enterprises, enabling access to multiple scenarios in agriculture, manufacturing, science and innovation, trade and government procurement

-

Open ecosystem with multi-dimensional data achieving a multi-dimensional portrait

Open ecosystem with multi-dimensional data achieving a multi-dimensional portraitGather logistics, information, commodity circulation and government data to show enterprise portrait and transaction panoramic portrait

-

End-to-end integration and multi-product one-stop empowerment scenarios

End-to-end integration and multi-product one-stop empowerment scenariosCovering aspects including industial and supply chains, procurement, transportation, and sales, connecting multiple financial products to empower multiple ecological entities in the scenario Enquire now

-

Joint operation to achieve win-win results

Joint operation to achieve win-win resultsAround the full cycle of platform growth and business scenarios, OneConnect provides "technology + business" services to crack the information asymmetry between banks and enterprises, and improve the level of government business supervision, so that enterprises, financial institutions and the government can achieve win-win results.

Customer Cases

-

SME financing platform in Guangdong Province

SME financing platform in Guangdong ProvinceBy providing technology + finance solutions, ConnectOne has created a Guangdong SME financing platform for the Guangdong government, linking the government, scenarios and banks, leveraging scenario-based financial cooperation and bringing high threshold and high quality sustainable revenue to banks.

As of June 30, 2022, nearly 1,500 financial products of 850 + financial institutions have been introduced to provide financing services for 1.3 million + SMEs.

Nearly 120 billion yuan have been raised.

-

Guangdong Rural Credit UnionInfo

Guangdong Rural Credit UnionInfo -

Guangxi Beibu Gulf BankInfo

Guangxi Beibu Gulf BankInfo -

Agricultural Development Bank of ChinaInfo

Agricultural Development Bank of ChinaInfo -

Shanghai Pudong Development BankInfo

Shanghai Pudong Development BankInfo -

Qujing City Commercial BankInfo

Qujing City Commercial BankInfo -

Guangdong SME Financing PlatformInfo

Guangdong SME Financing PlatformInfo -

Guangxi Beibu Gulf BankInfo

Guangxi Beibu Gulf BankInfo -

A finance holding companyInfo

A finance holding companyInfo -

Qujing City Commercial BankInfo

Qujing City Commercial BankInfo

- Solution Overview

- Business Challenges

- Product Solutions

- Product Strengths

- Customer Cases

Does this page meet your needs?

-

Yes

-

No

Your recognition and praise will motivate us to better improve the website experience