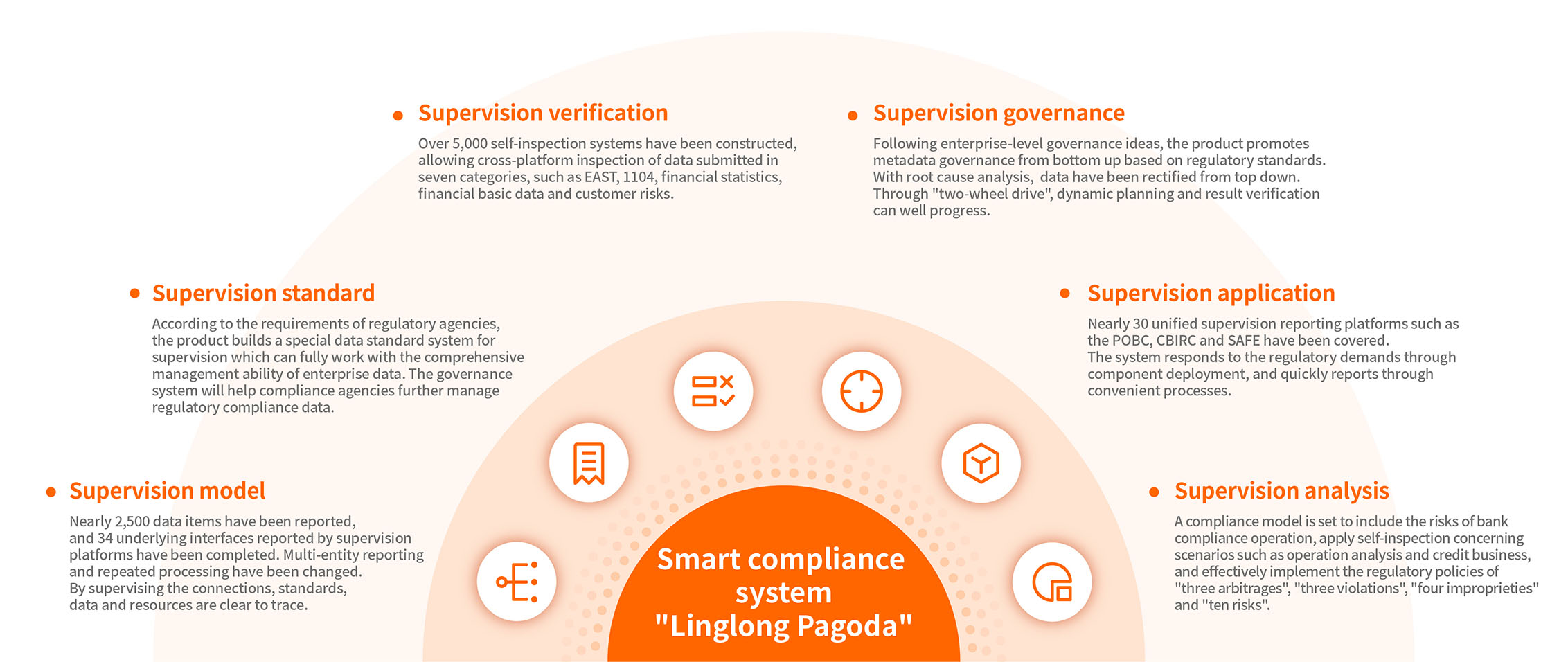

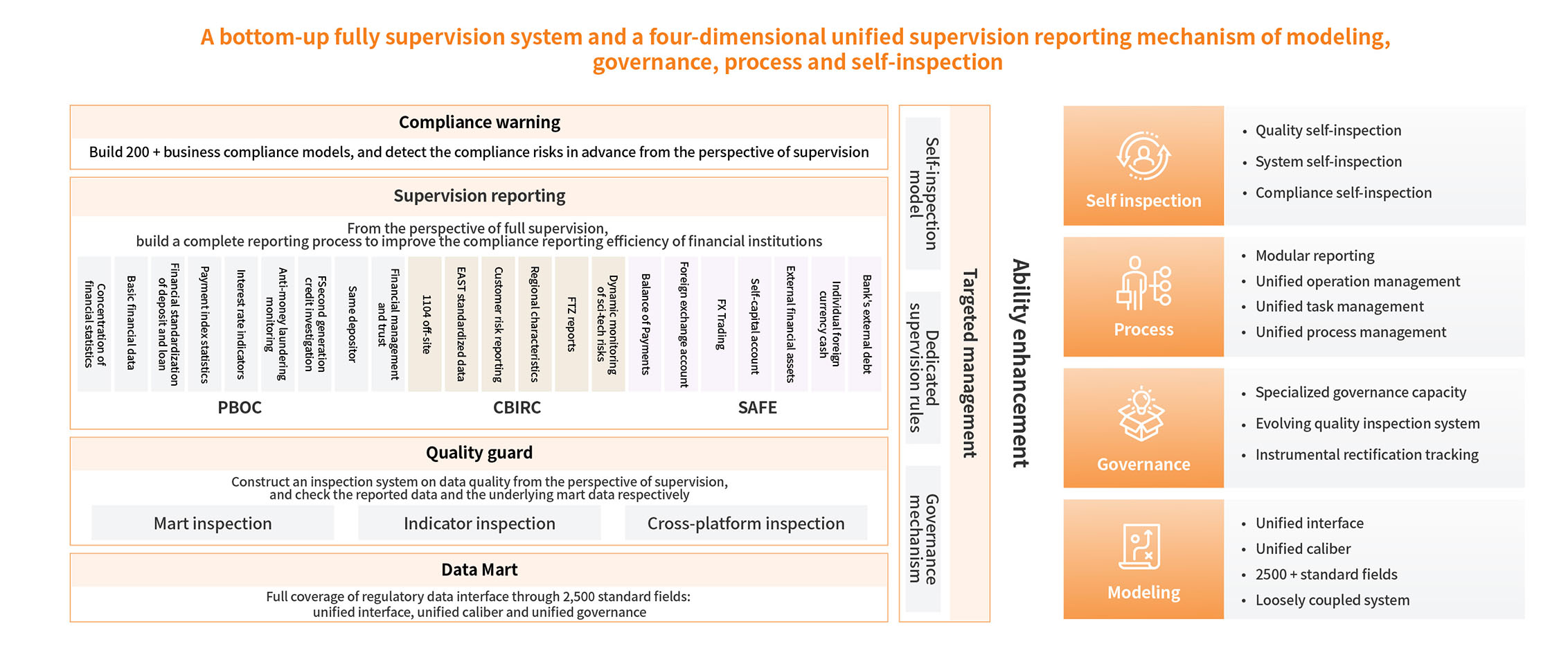

The "Linglong Pagoda" product system helps compliance institutions establish a "bottom-up" compliance reporting mechanism through flexible and convenient design and satisfy regulatory compliance reporting requirements. Compliance institutions are assisted to fully act on the Guidelines on Data Governance by developing regulatory dedicated governance framework, data standards, model marts, quality inspection rules and analysis ability.

Business Challenges

-

Multi-entity reporting and mixed criteria

Multi-entity reporting and mixed criteriaMultiple categories of reports submitted by regulatory authorities, and inconsistent standards and principles of submitted topics result in repeated supply and processing of compliance data, and high construction and maintenance costs.

-

Policy and principle interpretation

Policy and principle interpretationUnder strong supervision, the system is updated frequently, and the business is enlarged constantly. The reporting personnel from compliance institutions need to better understand the policies and principles.

-

Correction and implementation

Correction and implementationCompanies are unable to disclose and analyze the quality problems of regulatory data and quickly find the main responsible party of data to promote correction and implementation.

-

Governance objective and effect verification

Governance objective and effect verificationThe targets of governance work are unclear, and the governance content can not be well related to business production, bringing burden on evaluating and verifying governance effect quickly.

"Linglong Pagoda" product is a smart compliance system integrating model, standard, verification, governance, application and analysis. Both the underlying data control to the front-end compliance reporting satisfy general regulatory requirements, and unify compliance system, compliance application and compliance governance.

Product Strengths

-

Full supervision coverage

Full supervision coverageCover nearly 30 compliance reporting requirements of the PBOC, CBIRC, SAFE, and other regulatory authorities, and conduct unified supervision from bottom up.

-

Follow Guidelines on Data Governance

Follow Guidelines on Data GovernanceOver 400 built-in self-assessment models based on the Guidelines on Data Governance assist compliance institutions to regularly carry out self-inspection of regulatory compliance maturity and meet regulatory requirements.

-

Dedicated supervision standards

Dedicated supervision standardsProvide dedicated mart model and data standards for conducting full supervision, and apply governance ideas in constructing compliance specialized reporting system.

-

Dedicated close loop of rectification

Dedicated close loop of rectificationIn view of the quality of regulatory data, a long-term closed-loop mechanism of rectification is formed, which raises, pinpoints, solves and verifies problems.

-

Intelligent tool

Intelligent toolIn view of the quality of regulatory data, a long-term closed-loop mechanism of rectification is formed, which raises, pinpoints, solves and verifies problems.

Customer Cases

-

Build a dedicated data governance system for a city commercial bank in Zhejiang

Build a dedicated data governance system for a city commercial bank in ZhejiangResponding to quality problems of regulatory data, a "two-wheel drive" governance mechanism is established with over 800 regulatory dedicated data standards and "5 + 1" governance papers and online support tools.

The data governance is planned in the short, medium and long term from the perspective of supervision.

1600 + enterprise data standards

70 + root cause analysis models

50 + data quality rectification tracking indicators

-

Greatly enhance the efficiency of a city commercial bank in Beijing on supervision data application and analysis

Greatly enhance the efficiency of a city commercial bank in Beijing on supervision data application and analysisRelying on the regulatory data from CBIRC’s EAST and 1104, our product deeply analyses the business relationship of each data to explore the value of data application.

The compliance warning system based on regulatory data monitor compliance and build compliance self-inspection capability from nine scenarios, including credit fund flow and employees' illegal business behavior.

200 + compliance monitoring rules

800 + compliance checkpoints

-

Effectively guarantee the rapid running of a special supervision mart for a commercial bank in a city in Jiangxi

Effectively guarantee the rapid running of a special supervision mart for a commercial bank in a city in JiangxiTo facilitate the reporting work of CBIRC’s EAST and financial basic data of PBOC, in just three months, a fully regulated data mart system for the whole bank's compliance reporting scenario was quickly established.

Nearly 30 compliance reporting requirements of regulatory authorities such as PBOC, CBIRC and SAFE are contained.

2500 + supervision mart data, fully covering regulatory requirements

4400 + quality inspection system of supervision data to improve self-inspection ability

- Solution Overview

- Business Challenges

- Product Solutions

- Product Strengths

- Customer Cases

Does this page meet your needs?

-

Yes

-

No

Your recognition and praise will motivate us to better improve the website experience